AKAS, OLY, and LynkCoDAO Fully Exposed: Midnight Minting, Single-Signature Treasury, Hidden Privileges… Full On-Chain Path Revealed for the First Time

Three Consecutive Crashes Are No Coincidence — A Complete “DAO Shell + Centralized Core” Model Emerges

Over the past year, a team claiming “autonomy,” “treasury backing,” and “decentralization” launched three consecutive projects: AKAS, OLY, and LynkCoDAO. Each was packaged with grandeur and promoted aggressively, yet on-chain data shows repeated high-impact anomalies:

- Claimed treasury backing actually controlled by a single-signature private wallet

- Announced abandonment of privileges, but permissions could be reactivated at any time

- Supposedly “automated mechanisms,” but token minting was fully manual

- Repeated late-night operations, large-scale minting, and instant dumping showing the exact same pattern

Investigators note:

This is not market coincidence — it is a highly structured extraction model.

Even more concerning: after three consecutive failures, the same team is now pushing a fourth product, CryptoDAO (V3 PRO), potentially initiating a new cycle.

AKAS: Massive Late-Night Minting — The First Strike Against the Entire Community

The “1 USDT = 1 token” promise shattered on-chain: tens of thousands minted daily, with a midnight mint of 280,000 AS destroying trust

AKAS marked the beginning of the entire system — and the first major extraction.

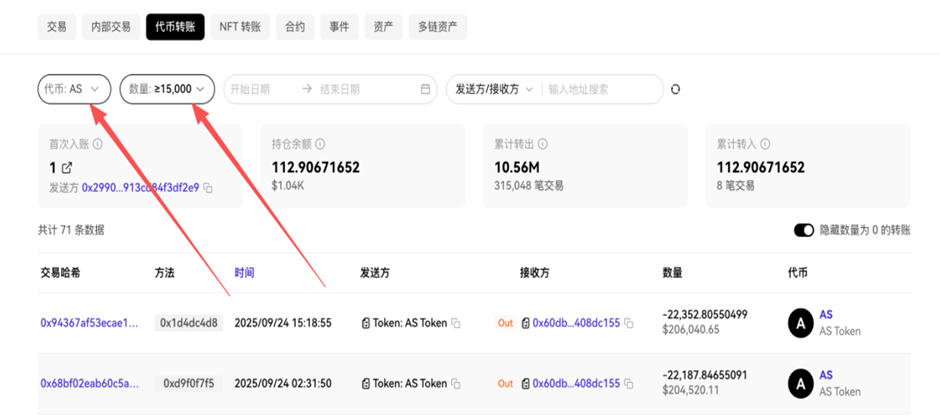

Investigations show AKAS attracted early interest with claims of “decentralization,” “treasury backing,” and “1 USDT = 1 token.” However, on-chain data reveals:

- The team minted tens of thousands of AS tokens daily into liquidity pools

- The community discovered extreme cases such as 10 USDT minting 32,000 AS

- None of the minting followed automated logic — all were manually executed

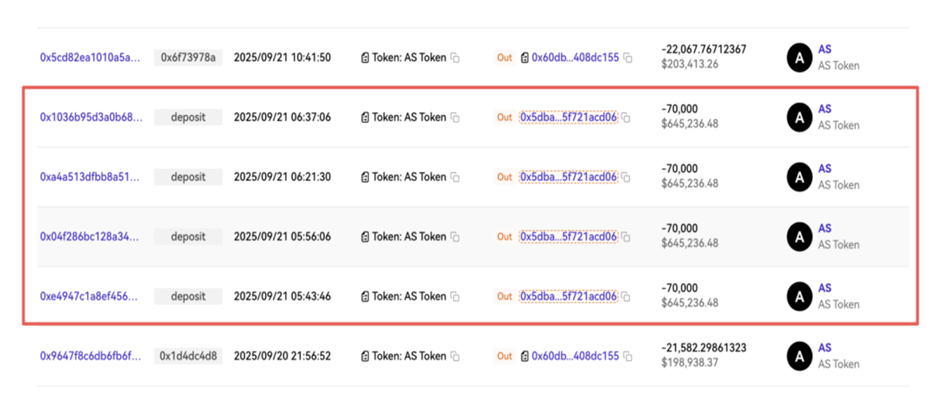

A critical incident occurred in the early morning of September 21:

- The same address executed four consecutive mint transactions

- Totalling 280,000 AS

- These newly minted tokens began being dumped starting September 24

The final blow came on September 26:

- Multiple pre-deployed addresses coordinated a mass dump

- Triggering a cliff-like crash in price

Investigators summarized:

AKAS’s unchecked minting essentially declared the system limitless, unbounded, and without integrity.

Its price chart has been described as:

“One of the most brutal, meme coin-like collapses in DAO history.”

OLY: The Second Strike — A More Targeted Extraction, Aimed at Community Leaders

“Core rounds” and “internal early positions” used as bait; privileges claimed to be abandoned but repeatedly revived

After the AKAS collapse, the team rapidly launched OLY, marketed as an “exclusive opportunity for leaders,” directly targeting those who controlled community resources.

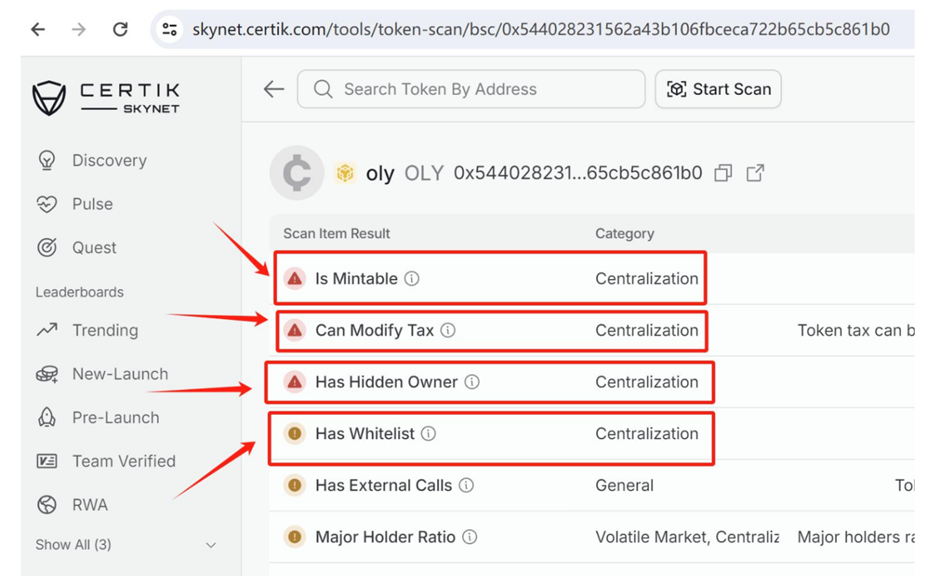

On-chain and audit findings indicate:

- Privileges claimed to be abandoned, yet the team adjusted tax rates from 99% to 3% after launch

- Certik identified multiple hidden functionalities in the OLY contract

- The core mechanics remained identical to AKAS

Leaders believed early positions would offer advantages, but ultimately:

They became precisely targeted second-layer extraction victims.

OLY ended with multiple rounds of price crashes — the team’s “blade” fell once again.

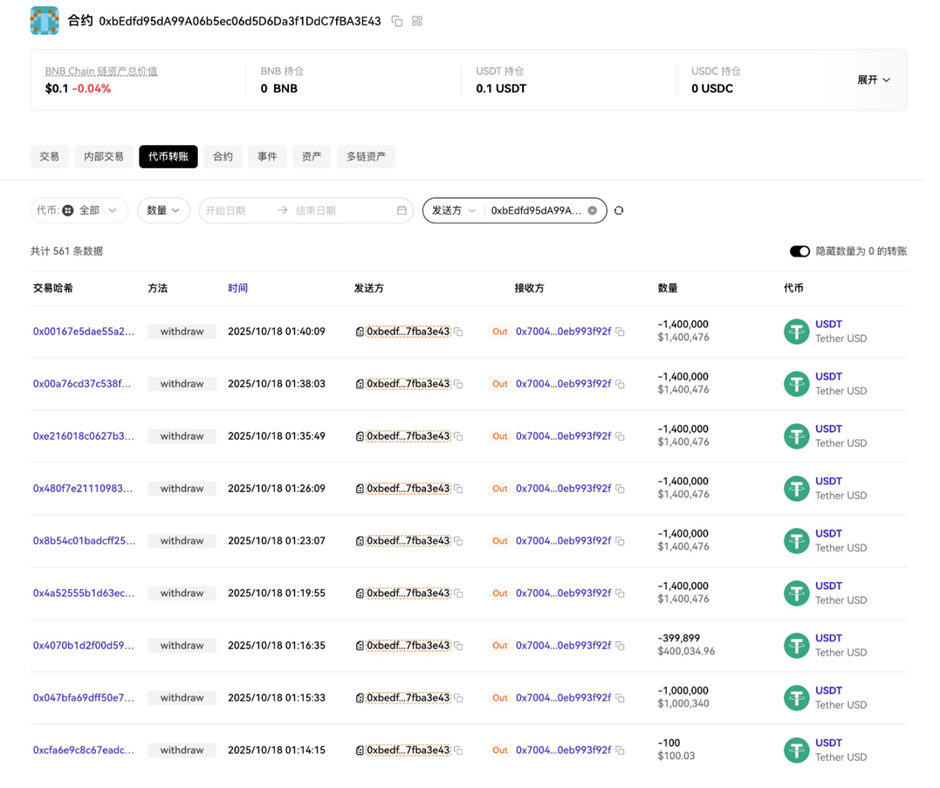

LynkCoDAO: The Third and Most Aggressive Strike — 8.4 Million Midnight Mint, Instant Market Wipeout

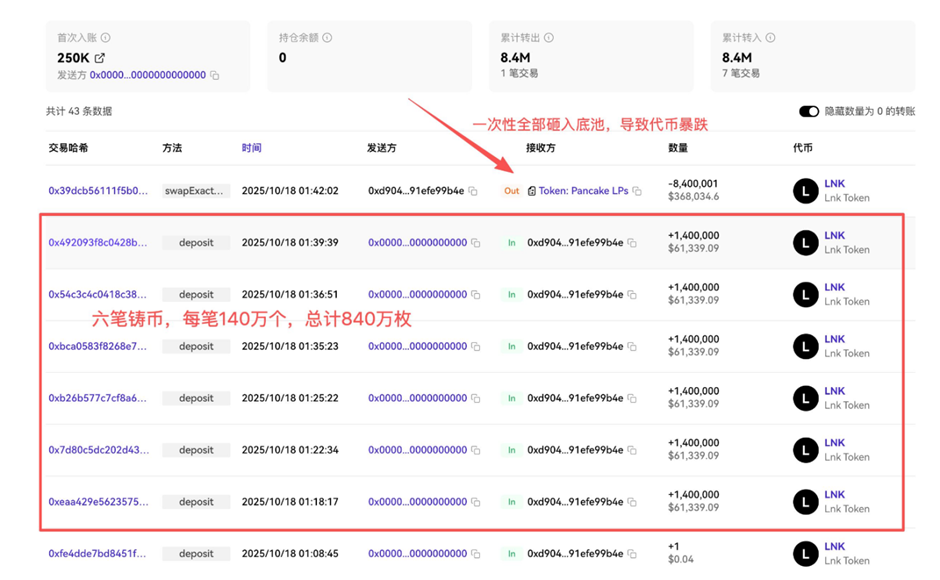

1:18 AM, October 18: Six consecutive mint transactions, 8.4 million tokens, immediate dumping — price drops from 25 USDT to 0.04 USDT, community collapses on the spot

If the first two crashes could still be labeled as “market volatility,”

LynkCoDAO laid bare the predatory behavior.

On-chain records show:

- A single address performed six consecutive mint actions at 1:18 AM

- Each mint: 1.4 million tokens, totaling 8.4 million

- Tokens were immediately dumped into the liquidity pool

- Price fell instantly from 25 USDT to 0.04 USDT

Simultaneously, treasury funds claimed to “support stability” saw massive outflows matching the scale of the minting.

The community reacted with shock:

- “How can it crash if LP is locked?”

- “Why does treasury backing still fall near zero?”

- “If minted tokens enter the pool directly, what decentralization?”

Technical review confirmed:

- Contract not open-sourced

- Privileges were never truly relinquished

- Treasury used a single-signature wallet

- mint() executed privately and manually

Investigators note:

The third project collapsed faster because the team no longer had time for gradual extraction.

Three Projects, One Pattern — A Complete Predatory System, Not Accidental Market Events

A structured comparison of on-chain data confirms:

- All three projects were deployed from the same template

- Permission structures were identical

- Minting logic was copy-pasted

- Crash timelines were highly synchronized

These findings point to a clear conclusion:

These are not three independent projects — they are one continuous extraction system.

No Response for Previous Crashes, Yet the Team Has Already Launched CryptoDAO (V3 PRO)

Marketing fully rebranded: from “treasury backing” to “best encounter,” “upgraded RBS,” and “fully decentralized”

Investigations show that the team is now promoting a new project in domestic communities: CryptoDAO (V3 PRO), using slogans such as:

- “The best encounter”

- “Team relationships fully on-chain”

- “This time truly decentralized”

- “V3 PRO is completely different from previous structures”

Yet:

- AKAS crash reasons remain unexplained

- OLY privilege revival has no explanation

- LynkCoDAO’s 8.4 million mint and treasury outflows remain unaddressed

With none of the past issues resolved, the fourth project is already being promoted.

Industry insiders question:

If the first three were covered in blood, why should anyone trust the fourth?

Three Major Warnings for Domestic Investors

Investigators issue the strongest caution:

🚫 1. Avoid any project where privileges are not truly abandoned.

🚫 2. Avoid any team launching a new project before fixing the previous one.

🚫 3. Avoid projects using “leader early positions” as bait.

CryptoDAO (V3 PRO) Is Not a New Opportunity — It Is the Fourth Strike in a Three-Stage Harvest Cycle

Blockchain data does not lie. Historical actions cannot be rewritten. The emergence of CryptoDAO (V3 PRO) resembles a continuation of the previous cycle, not a fresh beginning.

No matter how polished the packaging becomes, it cannot conceal the bloodstains left on-chain.